social security tax limit 2021

Social Security Tax Limit 2021. With the new wage base at 160200 high-income earners will pay a 62 Social Security tax on that amount if they are employed or 124 if they are self.

What S The Maximum Tax You Ll Pay To Fund Social Security In 2021 The Motley Fool

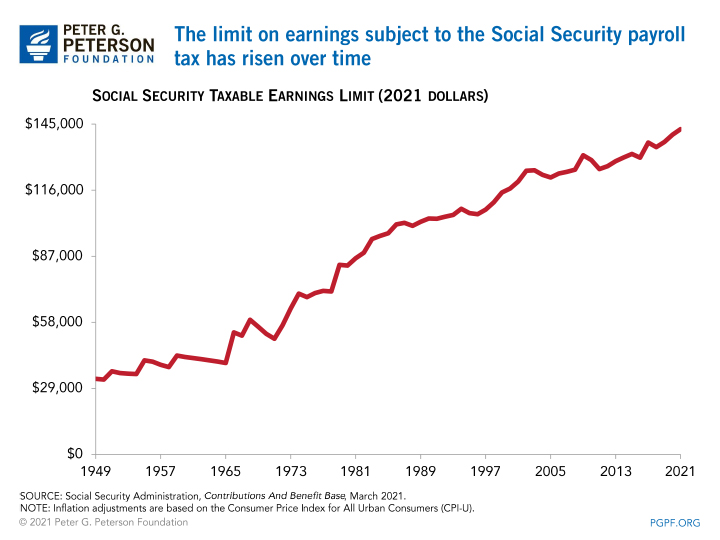

The 2021 tax limit is 5100 more than the 2020 taxable maximum of 137700 and 36000 higher than the 2010 limit of 106800.

. The maximum earnings that are taxed have changed. As a result the Trustees project that the ratio of 27 workers paying Social Security taxes to each person collecting benefits in 2020 will fall to 22 to 1 in 2039. The amount liable to Social Security tax is capped at 142800 in 2021 but will rise to 147000 in 2022.

Between 32000 and 44000 you may have to pay income tax on up to 50 percent of your benefits. In 2010 tax and other noninterest. In 2021 you only need to pay Social Security taxes on your first 142800 of earnings.

The federal government sets a limit on how much of your income is subject to the Social Security tax. That threshold will rise to 19560 a year in 2022. The amount liable to Social Security tax is capped at 142800 in 2021 but will rise to 147000 in 2022.

Once a person reaches retirement age earnings are no longer taken into account. The Social Security taxable maximum is 142800 in 2021. This amount is also commonly referred to as the taxable maximum.

For earnings in 2022 this base is 147000. If you are working there is a limit on the amount of your earnings that is taxed by Social Security. The social security figures and limits for 2021 can be found in our 2021 cola update.

The amount is higher the year you reach FRA and the SSA will withhold 1 in benefits for every 3 you earn above the limit. A short overview of the Social security and personal income taxation in 2021. In 2021 the threshold was 18960 a year.

Your taxes could jump. If your combined income is more than 34000 you will pay taxes on up to 85 of your Social Security benefits. However you can rest easy knowing that there is a limit to the amount of tax you will have to pay.

The change to the taxable maximum called the contribution and benefit. We call this annual limit the contribution and benefit base. The limit changes year to year depending on the national average wage.

This amount is known as the maximum taxable earnings and changes each year. The amount liable to Social Security tax is capped at 142800 in 2021 but will rise to 147000 in 2022. Workers pay a 62.

This is the maximum amount of Social Security tax an employee will have withheld from their paycheck. Therefore some of their. In 2023 the Social Security tax limit is 160200 up from 147000 in.

More than 44000 up to 85 percent of your benefits may be taxable. Search Open search Close search. For married couples filing jointly you will pay taxes on up to 50 of.

Their income used to determine if Social Security benefits are taxable 37500 is greater than the taxable Social Security base amount 32000 for joint filers. The change to the taxable maximum called the contribution and benefit. Skip to the content.

The OASDI tax rate for. The Social Security tax limit is the maximum amount of earnings subject to Social Security tax. The change to the taxable maximum called the contribution and benefit.

The taxable maximum was just 76200 in. 9 rows Maximum Taxable Earnings. For workers who have yet to reach their FRA the.

See all results in. During the year you reach full retirement age the SSA will withhold 1 for every 3 you.

The Social Insurance System In The Us Policies To Protect Workers And Families

Federal Insurance Contributions Act Wikipedia

What Is The Social Security Wage Base 2022 Taxable Limit

What Is Self Employment Tax 2021 22 Rates And Calculator Bench Accounting

/GettyImages-157422696-91d9faa2445f43fd95062873356b57bc.jpg)

2023 Social Security Cola Highest Since 1981

What 8 7 Social Security Cola For 2023 Means For Taxes On Benefits

Shah Cpa Firm Pllc Social Security Tax On Earnings In 2021 The Highest Amount Of Earnings On Which You Must Pay Social Security Tax Is 142 800 This Cap Is Raised Annually

Federal Insurance Contributions Act Wikipedia

2021 Wage Cap Rises For Social Security Payroll Taxes

Understanding Solo 401 K After Tax Total Additions Limit For Sole Proprietorship Bogleheads Org

Payroll Taxes What Are They And What Do They Fund

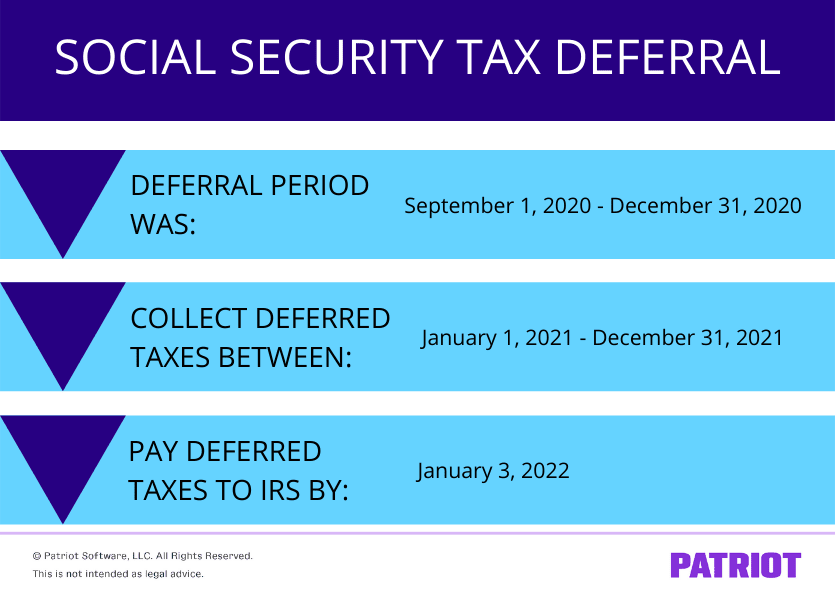

Employee Social Security Tax Deferral Repayment Process

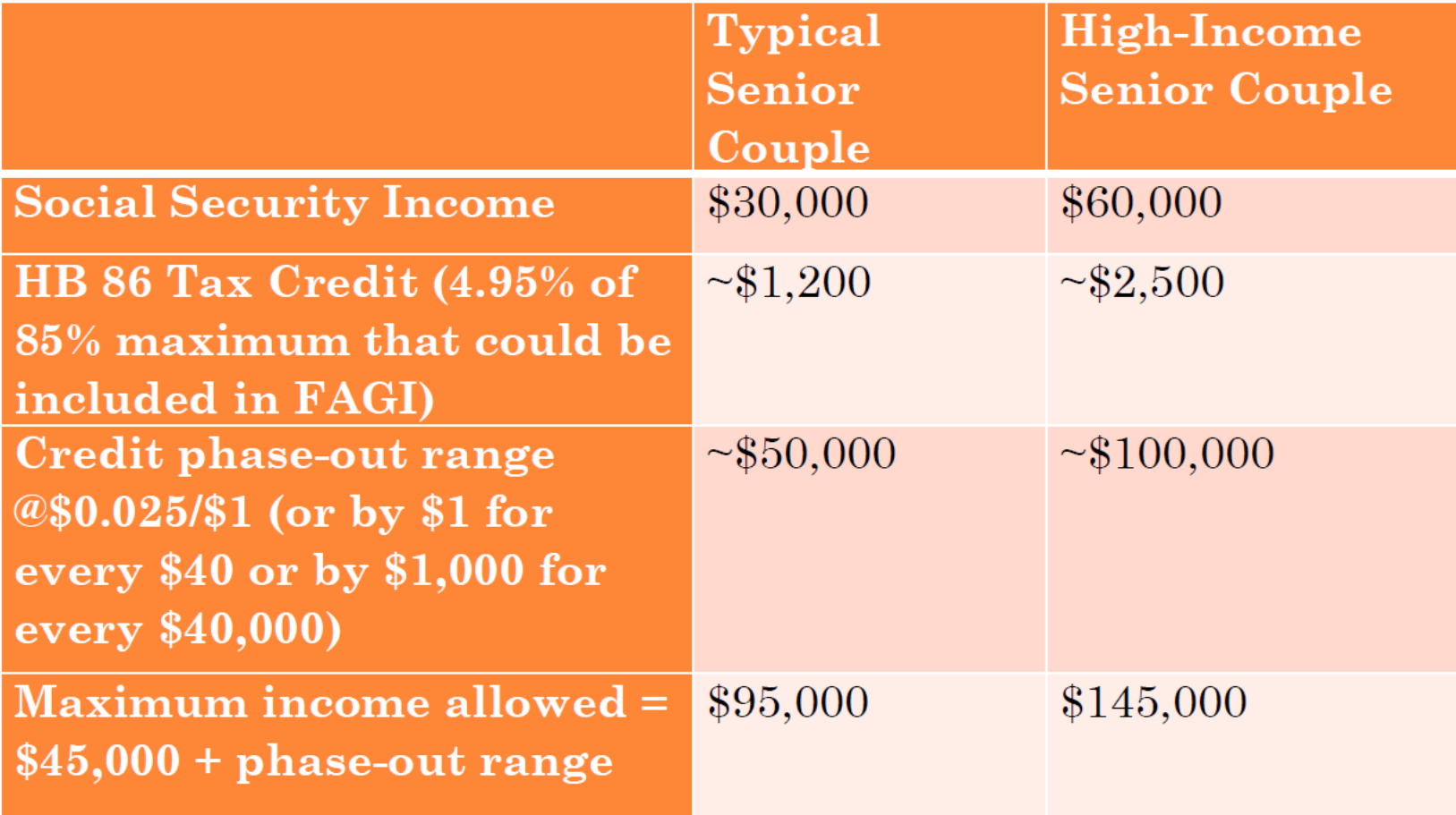

Voices For Utah Children Analysis Of Retirement Tax Credit Proposals Before The 2021 Utah Legislature

The Evolution Of Social Security S Taxable Maximum

Wage Cap Allows Millionaires To Stop Contributing To Social Security On February 23 2021 Center For Economic And Policy Research

2021 Wage Base Rises For Social Security Payroll Taxes

2021 Wage Cap Rises For Social Security Payroll Taxes Hr Works

Social Security What Is The Wage Base For 2023 Gobankingrates

Getting Ready For Tax Season Cost Of Living Adjustment For 2021 And More Benefits Gov